【推文】Logan Lancing - ESG isn't about making businesses better. It’s about making businesses obedient.

這是 Logan Lancing 最近寫的長推文

連結

原推文 - x.com/LoganLancing/s...

Thread Reader App版本(一頁版本) - threadreaderapp.com/...

原文及個人翻譯

Why did Jaguar do the thing?

Why did Harley do the thing?

Why is every company doing the thing and alienating their consumer bases-- bases they understand more than they understand themselves?

Environmental, Social, Governance (ESG)

以下是英文到繁體中文的翻譯:

為什麼Jaguar(汽車公司)會做那件事?

為什麼Harley會做那件事?

為什麼每家公司都在做那件事,並疏遠他們的消費者群體——他們比自己更了解的群體?

環境、社會、治理(ESG)

(Pika:下附Jaguar廣告,因為我看過,要看整段廣告可到youtu.be/rLtFIrqhfng但不是本文重點)

ESG stands for Environmental, Social, and Governance. It's a framework used to measure a corporation's impact on society and the environment. Sounds harmless, right? Nope.

The term gained traction from the UN’s "Principles for Responsible Investment" (2006), a global effort to integrate environmental and social concerns into investment decisions. Major financial players like BlackRock and Vanguard popularized it.

The official reasoning was to ensure "sustainable" business practices, reduce risks tied to climate change, and promote diversity and equity.

ESG 代表環境(Environmental)、社會(Social)和治理(Governance)。它是一個用於衡量企業對社會和環境影響的框架。聽起來無害,對吧?不,不是。

這個術語來自聯合國「負責任投資原則」(2006 年),這是一項全球性努力,旨在將環境和社會問題納入投資決策。像黑岩(BlackRock)和先鋒(Vanguard)這樣的金融業主要玩家使它被普及。

官方的理由是確保「可持續」的商業實踐,減少與氣候變化相關的風險,並促進多樣性和公平性。

ESG creates a "score" for companies.

A high ESG score signals compliance with certain values—carbon reduction, diversity quotas, etc. A low score marks you as a risk. Investors, banks, and governments use this score to decide your access to capital.The framework isn't neutral. ESG criteria are set by unelected bodies—global financial institutions, NGOs, and think tanks. They decide which values matter and how they're measured.

It’s about control. If a corporation doesn’t comply, they face exclusion from financial markets, restricted access to loans, and public smears. It’s extortion dressed up as virtue.

It shifts corporate priorities.

Instead of serving customers and shareholders, companies must serve political agendas. Profits take a backseat to meeting arbitrary ESG targets—often at the expense of employees and consumers.

Shareholders give way to "stakeholders."

ESG 為公司創建了一個「得分」系統。

高 ESG 得分表示符合特定價值觀——例如減碳、多樣性配額等。低分則標記你為風險。投資者、銀行和政府使用這個得分來決定你的資本獲取權。

這個框架並不中立。ESG 標準是由未經選舉的機構——全球金融機構、非政府組織和智庫——設定的。他們決定哪些價值觀重要,以及如何衡量它們。

這關乎控制。如果一家公司不遵守,他們將面臨被排除在金融市場之外、貸款獲取權受限,以及公開聲譽受損。這是一種以美德為名進行的勒索。

它改變了企業的優先事項。

而不是為客戶和股東服務,公司必須為政治議程服務。利潤讓位於滿足任意的 ESG 目標——通常以員工和消費者的利益為代價。

股東讓位於「利益相關者」。

Take energy as an example:

Fossil fuel companies are penalized with low ESG scores. This limits their funding and pushes investment toward "green" initiatives, even if those alternatives are unproven, more expensive, less reliable, or less efficient.ESG is a Trojan horse. It’s sold as a tool for progress, but it’s a backdoor to enforce ideological conformity across industries. If you control the money and incentives, you control the decisions.

以能源為例:

化石燃料公司因低 ESG 得分而受到懲罰。這限制了他們的資金,並推動投資流向「綠色」倡議,即使這些替代方案未經證實、更昂貴、更不可靠或效率更低。

ESG 是一個特洛伊木馬。它被宣傳為進步的工具,但它是一個後門,用於在各行各業強制執行意識形態一致性。如果你控制了金錢和激勵措施,你就控制了決策。

ESG isn't about making businesses better.

It’s about making businesses obedient. The question isn't whether corporations should act ethically—it’s who decides what “ethical” means.ESG centralizes power, erodes free markets, and imposes a one-size-fits-all ideology on every business and consumer.

ESG 不是為了讓企業變得更好。

它是為了讓企業變得服從。問題不在於企業是否應該採取道德行為,而在於誰決定「道德」是什麼。

ESG 集中權力,侵蝕自由市場,並向每家企業和消費者強加一種適合所有人的意識形態。

Why did Jaguar do the thing? Extortion.

Jaguar did the thing, knowing full well that they would commit "brand suicide." But Jaguar did the calculus and determined that doing brand suicide was the LESS EXPENSIVE path forward; it was better than taking the ESG hit, which is worse.

Also see: Corporate Equality Index (CEI), among other wicked instruments of control.

為什麼Jaguar會做那件事?勒索。

Jaguar明知他們會犯下「品牌自殺」的錯誤,但他們進行了計算,並確定了品牌自殺是更經濟的前進道路;這比遭受 ESG 的打擊更好,後者更糟糕。

也請參閱:《企業平等指數》(CEI)等其他惡意控制工具。

額外內容

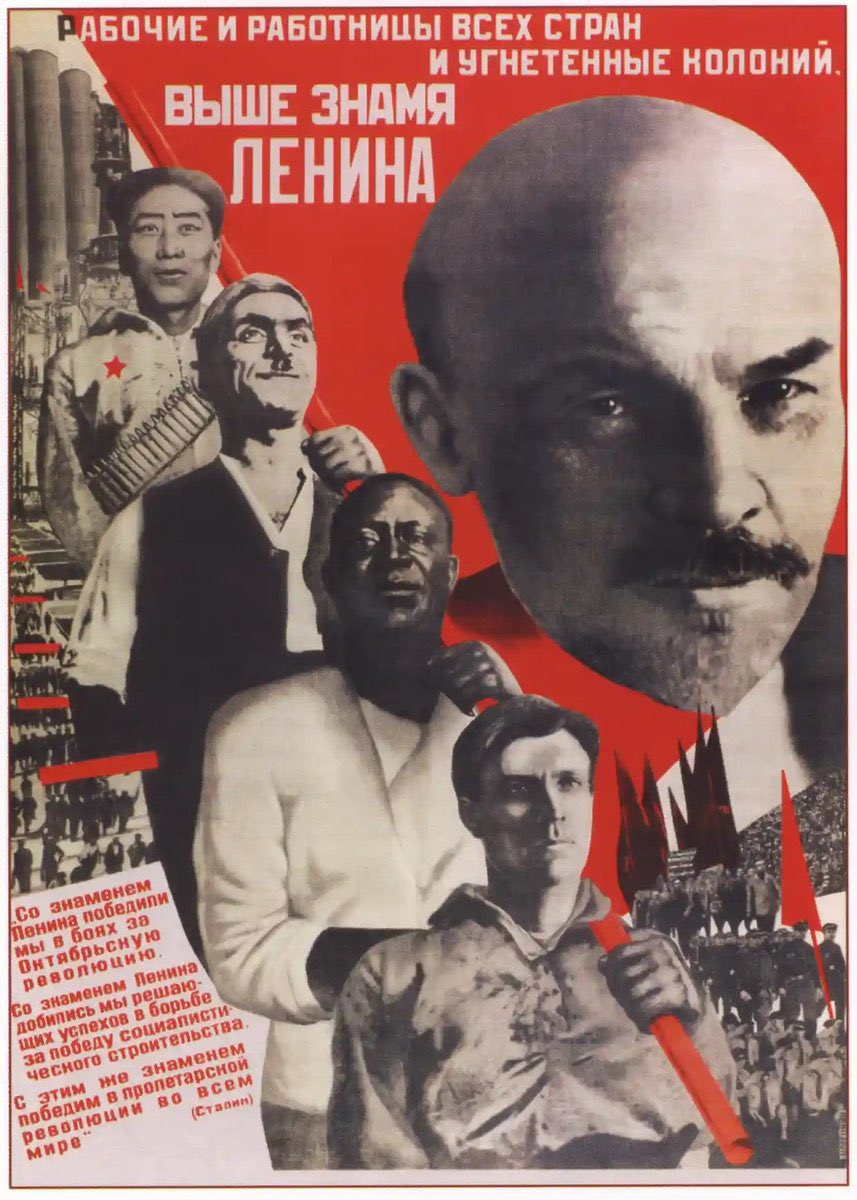

引用上面推文的推文 - The original plans from Lenin

1/ Lenin’s Communist Ethics & Control of Capitalism to be socially useful…Read Logan’s post on the purpose of ESG (part of an easy-to-understand ); I will now expose the original plans from Lenin…

1/ 列寧的共產主義道德與資本主義的控制以成為對社會有用的...閱讀Logan關於 ESG 目的的貼文(易於理解的一部分);我現在將揭露列寧的原始計劃...

2/ Lenin (1921) usurped Capitalism, in order to make the “work”, “socially useful”.Using “methods of siege and undermining”, they would “prove capable of keeping a proper reign on these gentlemen, the capitalists” - to “direct capitalists”; to make capitalism “subordinate”.

2/ 列寧(1921)篡奪了資本主義,以便使其「運作」成為「對社會有用的」。使用「圍攻和破壞的方法」,他們將「證明能夠對這些資本家保持適當的控制」——「指導資本家」;使資本主義「服從」。

3/ The control of the production of capitalism, for “socially useful material values” is solely based on:“Communist morality” of “the struggle for the consolidation & completion of Communism”; “Communist ethics” based on “class struggle”. (Lenin,1920)

3/ 資本主義生產的控制,為了「對社會有用的物質價值」,僅基於「共產主義道德」——「鞏固和完成共產主義的鬥爭」;基於「階級鬥爭」的「共產主義倫理」(列寧,1920)。

4/ ESG exemplifies Lenin’s goal of taking control of capitalism before the capitalists could-using ethics of Communism to direct & subordinate the production of capitalism to socialistic aims.This 1920s NEP (New Econ Policy) movement took place as Soviet DEI was launched.

4/ ESG 體現了列寧的目標——在資本家之前控制資本主義,使用共產主義的道德觀來指導和使資本主義的生產服從於社會主義目標。這場上世紀 20 年代的《新經濟政策》(NEP)運動與蘇聯DEI的啟動同時發生。

蘇聯DEI相關推文 - DEI came from the Soviet Union

Stalin's proposed solution to the "national question" turns out to be a project called "nativization" (коренизация, korenizatsiya) combined with a focus on "unity through diversity" (разнообразие, raznoobraziya). We call these programs DEI once "actual equality" is added in.

斯大林對「民族問題」的解決方案證明是一個名為「本地化」(коренизация,korenizatsiya)的項目,加上對「透過多元團結」(разнообразие,raznoobraziya)的關注。當「實際平等」被加入後,我們將這些計劃稱為 DEI。